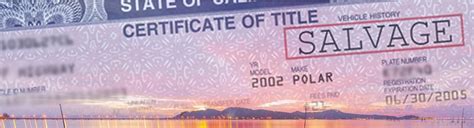

When a vehicle undergoes significant repairs or rebuilding, it can have a substantial impact on its insurance status. A rebuilt title, also known as a salvage title, is issued by the Department of Motor Vehicles (DMV) when a vehicle has been damaged to the point where repair costs exceed a certain percentage of its value, typically between 50% to 70%. This designation can affect insurance premiums, coverage, and even the ability to obtain insurance in the first place.

Understanding Rebuilt Titles

A rebuilt title is a permanent designation on a vehicle’s title that indicates it has been previously damaged and repaired. This can be due to various reasons such as accidents, floods, or fires. While a rebuilt title does not necessarily mean the vehicle is unsafe or unreliable, it can raise concerns for insurance providers. Insurers view rebuilt title vehicles as higher-risk, which can lead to increased premiums or limited coverage options.

Insurance Implications of Rebuilt Titles

Insurance companies consider several factors when determining premiums for vehicles with rebuilt titles. These factors include the vehicle’s make, model, and year, as well as the extent of the damage and repairs. Generally, insurance premiums for rebuilt title vehicles are higher due to the increased risk of future claims. Some insurance providers may also offer limited coverage options or exclude certain types of coverage, such as comprehensive or collision insurance.

| Insurance Type | Impact of Rebuilt Title |

|---|---|

| Liability Insurance | Minimal impact, as liability insurance covers damages to other parties |

| Comprehensive Insurance | Potential for higher premiums or limited coverage due to increased risk of future claims |

| Collision Insurance | Potential for higher premiums or limited coverage due to increased risk of future claims |

Key Points

- A rebuilt title can increase insurance premiums due to higher risk

- Insurance providers may offer limited coverage options for rebuilt title vehicles

- The extent of damage and repairs can impact insurance premiums and coverage

- Liability insurance is less affected by rebuilt titles compared to comprehensive and collision insurance

- Researching and comparing insurance quotes from multiple providers is essential for finding the best option

Obtaining Insurance for Rebuilt Title Vehicles

While it may be more challenging to obtain insurance for a rebuilt title vehicle, it’s not impossible. Some insurance providers specialize in covering high-risk vehicles, including those with rebuilt titles. These providers may offer more flexible coverage options or specialized policies designed for rebuilt title vehicles.

Specialized Insurance Providers

Specialized insurance providers, such as those that focus on high-risk or non-standard insurance, may offer more competitive rates and coverage options for rebuilt title vehicles. These providers often have more experience handling high-risk vehicles and may be more willing to work with owners of rebuilt title vehicles.

However, it's essential to note that even with specialized insurance providers, rebuilt title vehicles may still face higher premiums or limited coverage options. As an owner of a rebuilt title vehicle, it's crucial to carefully review insurance policies and quotes to ensure you're getting the best possible coverage for your vehicle.

FAQs

Can I get insurance for a rebuilt title vehicle?

+Yes, you can get insurance for a rebuilt title vehicle, but it may be more challenging and expensive. Some insurance providers specialize in covering high-risk vehicles, including those with rebuilt titles.

How much does a rebuilt title affect insurance premiums?

+The impact of a rebuilt title on insurance premiums can vary significantly depending on the insurance provider, vehicle, and extent of damage. On average, rebuilt title vehicles may face 10-20% higher premiums compared to vehicles with clean titles.

Can I get full coverage insurance for a rebuilt title vehicle?

+It may be more challenging to get full coverage insurance for a rebuilt title vehicle, as some insurance providers may offer limited coverage options or exclude certain types of coverage. However, some specialized insurance providers may offer more comprehensive coverage options for rebuilt title vehicles.

In conclusion, a rebuilt title can significantly impact insurance premiums and coverage options for vehicles. While it may be more challenging to obtain insurance for a rebuilt title vehicle, it’s not impossible. By researching and comparing insurance quotes from multiple providers, including specialized insurance providers, owners of rebuilt title vehicles can find the best possible coverage for their vehicle.