When it comes to managing debt, understanding the concept of principal payments is crucial. Principal payments refer to the amount of money borrowed that is being paid back, excluding interest. In other words, it is the amount that is being applied to the outstanding balance of a loan or mortgage, reducing the total amount owed. For individuals and businesses alike, making principal payments is essential to paying off debt efficiently and saving money on interest over time.

In the context of loans, principal payments are typically made alongside interest payments. The interest payment is the cost of borrowing, calculated as a percentage of the outstanding principal balance. When a borrower makes a payment, a portion of it goes towards covering the interest accrued since the last payment, while the remaining amount is applied to the principal. As the principal balance decreases, so does the interest charged, resulting in lower interest payments over time. This is why making extra principal payments or increasing the frequency of payments can significantly reduce the total interest paid over the life of the loan.

Key Points

- Principal payments reduce the outstanding balance of a loan, excluding interest.

- Making extra principal payments can save money on interest over time.

- The frequency and amount of principal payments impact the total interest paid.

- Understanding principal payments is crucial for efficient debt management.

- Principal payments are a key component of loan repayment strategies.

Understanding Principal Payments in Different Loan Types

Different types of loans have varying structures when it comes to principal payments. For instance, in an amortizing loan, such as a mortgage or car loan, each payment includes both interest and principal. The proportion of interest to principal changes over the life of the loan, with early payments consisting mostly of interest and later payments consisting mostly of principal. This type of loan is designed so that the borrower pays the same amount each month, but the allocation between interest and principal changes.

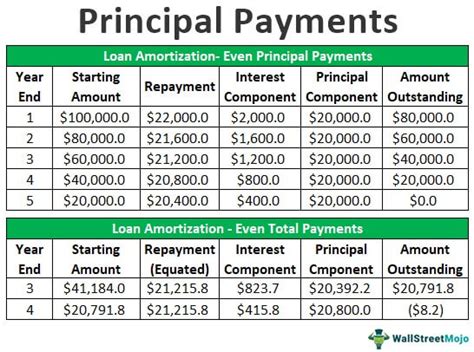

Amortization Schedules and Principal Payments

An amortization schedule is a table that outlines each payment on a loan, detailing how much of the payment goes towards interest and how much towards the principal. By examining an amortization schedule, borrowers can see exactly how their principal payments are reducing the outstanding balance of the loan over time. This tool is invaluable for planning and understanding the impact of making extra principal payments or adjusting the loan term.

| Payment Number | Payment Amount | Interest Paid | Principal Paid |

|---|---|---|---|

| 1 | $1,000 | $800 | $200 |

| 2 | $1,000 | $780 | $220 |

| 3 | $1,000 | $760 | $240 |

Strategies for Making Principal Payments

There are several strategies that borrowers can employ to make the most of their principal payments. One approach is to make extra payments whenever possible, which can significantly reduce the total interest paid and the term of the loan. Another strategy is to increase the frequency of payments, such as switching from monthly to bi-weekly payments, which can also result in making one extra payment per year.

For those who cannot afford to make extra payments, simply understanding how principal payments work and ensuring that each payment is made on time can make a significant difference. Late payments can lead to additional fees and increase the overall cost of the loan, underscoring the importance of timely payments in managing debt efficiently.

Bi-Weekly Payments and Their Impact on Principal

Making bi-weekly payments instead of monthly payments is a strategy that can reduce the principal balance faster. By paying half of the monthly payment every two weeks, borrowers essentially make 26 payments per year, compared to 12 monthly payments. This results in making one extra payment per year, which can significantly reduce the total interest paid over the life of the loan.

In conclusion, principal payments are a critical component of loan repayment, offering borrowers a way to reduce their debt and save money on interest. By understanding how principal payments work and employing strategies such as making extra payments or increasing payment frequency, individuals and businesses can efficiently manage their debt and achieve financial stability.

What is the difference between a principal payment and an interest payment?

+A principal payment is the amount applied to the outstanding balance of a loan, reducing the total amount owed. An interest payment, on the other hand, is the cost of borrowing, calculated as a percentage of the outstanding principal balance.

How do I make extra principal payments on my loan?

+Consult your loan agreement or contact your lender to determine the best way to make extra principal payments. Some lenders may allow online payments, while others may require a phone call or visit to a branch.

Will making extra principal payments save me money on interest?

+Yes, making extra principal payments can significantly reduce the total interest paid over the life of the loan. By reducing the principal balance, you also reduce the amount of interest charged, leading to savings.